(Source : Nomura Research)

(Source : Nomura Research)

(Source : www.livemint.com and RBI)

Over the last 1.5 years, Indian Real estate sector has seen a tumultuous journey. Starting with the fall in Q3 2008, real estate sector has seen recovery in some sectors while the other sectors have yet to see recovery. Commercial real estate (Office space) has seen increasing absorption across India. Q1 2010 absorption across India has been very positive compared to Q1 2009. However the vacancy levels are still quite high, and with additional space expected to come into the market, vacancy levels would remain high.Rentals have been stable over the last one year, BKC and Gurgaon are the two markets which have seen a slight increase in rentals. However, increase supply of space in these two markets would keep the rentals under check in these two markets. Retail space has also not seen any recovery yet.

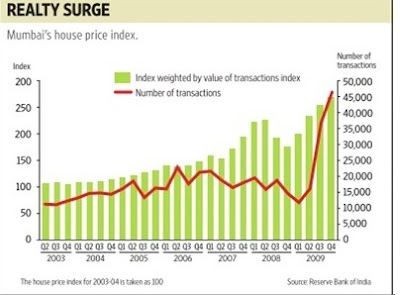

Residential space has seen a strong recovery over the last one year. However this recovery has not been spread across India.Hyderabad, Chennai, Bangalore have not seen the high jumps that Mumbai and Gurgaon markets have seen. Prices in Mumbai have surged 31% Y-o-Y basis and prices have increased more than the 2008 levels. Affordability (EMI/monthly income) has increased to nearly 85% and is near 2007 levels.

My personal belief is that these two markets are in a bubble zone. The main reasons for this belief area,

1.This increase in prices has been quite sharp and very localised. This localisation indicates that the broad based economic recovery has not been the only reason for this increase.

2. Increased liquidity and low barriers to availability of money.

3. Increasing stress towards high spec residential space.

4. Strong co-relation to the stock market movements.

5. Strong surge in transaction volumes in a short period.