(Source: RBI Q2 review)

(Source: RBI Q2 review)The main risk factor which i had pointed out in my last blog is going to play a key role in the coming few days. Global economies are currently facing a key decision factor with regard to economies recovery. key countries which had implemented fiscal and other incetives to boost their economies during the period of 2008-09 are now being forced to think and act on removing these incentive schemes due to rising inflation. China has started the process, India is expected to raise interest rates in the coming quarterly policy review. The declines in global markets and strong performace of the dollar over the last one week are a reflection of the fears that market participants have, on the adverse impact due removal of these incentives. The declines indicate that the market feels that the recovery was due to these incentives rather than due to any demand recovery. So what does all this hold for India? The impact of the increasing risk aversion to emerging markets due to fears of a bubble or lower growth due to increasing monetary tightening is being felt and would continue for the next few weeks.

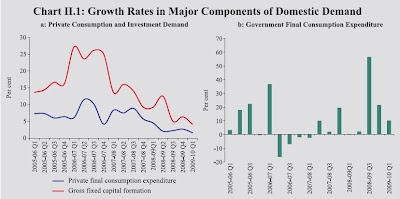

Let us analyse the performance of the Indian economy through the basic GDP formula, Y= C+I+G+NX.The growth of the Indian economy over the last few quarters has been helped to a great extent by the fiscal push by the government (G). The last quarter has seen the impact of the fiscal push through increased growth in the social and community services expenditure, which is funded by the government.With the government looking at reining in the fiscal deficit, the key growth factors for the Indian economy would be the recovery of the private consumption(C) and Investment(I). With the world economy still weak, growth in the exports would be lower, hence the need for C and I to grow. Growth in Private consumption fell to 1.6% in the first quarter of 2010 and but increased by 5.6 % in the Q2 2009-2010. The impact of the bad monsoon is expected to be felt in Q 3 2009-10 and this is expected to adversely impact the consumption in rural india. Investment growth has still not picked up. The Q 3 2009-10 could see a lower growth as compared to Q 2 2009-10 which had seen the main impact of increased government expenditure and private consumption.So is the government going to start the process of removal of incentives or has the Indian Economy recoverd and is ready to move forward with Government support? The policy review of RBI may give us some hint on these questions.