Wednesday, October 13, 2010

Are Government Auctions optimal?

Wednesday, August 18, 2010

Urban Serfdom

Serfdom the once widely prevalent practice in rural populace, wherein the landless farmers would be enslaved to work in the fields of the landowners for perpetuity. With increasing economic growth the urban populace is also increasing the disposable incomes available with the populace. But is this increase in disposable income creating increasing wealth in the hands of the urban populace. Rather than wealth creation, consumption is taking a higher chunk of the disposable incomes in India. India has been a consumption driven economy over the last decade and the private consumption is a growth story. Easy access to credit is fuelling this growth of consumption. Credit purchases have increased and cover a wide variety of products starting from clothes. This every increasing dependence on consumption goods is only going to increase the dependence of the urban populace on credit and reduce financial independence which is very critical for wealth creation. We are looking at a situation wherein wealth is increasingly being concentrated in the hands of few and transfer of wealth taking place from a majority to the minority.

Let’s take an example of home ownership to understand this transfer of wealth. In a city like Mumbai, the cost of an average sized apartment is near to the seven figure mark. With easy access to credit, majority of the people would invariably take huge loan amount to acquire the apartment. The tenor would be for 10 to 15 year period. This leads to creation of a long term liability which the buyer has to service and this puts him dependent on his income to service the loan. The monthly payment would comprise a major chunk of the monthly earnings. Any negative impact on the buyer’s income earning capacity negatively impacts his ability to service the liability. Thus the person is highly dependent on his job. The situation of the buyer is similar to that of the landless farmer who has been caught in serfdom; the ownership of the apartment makes him more dependent on the vagaries of the economy and less financial independent. The entire consideration is being paid by the buyer to a developer who enjoys a high margin due to the faulty market and regulatory practices which have enabled them to form artificial monopolies.

Financial independence seems to be eluding the urban populace and in absence of a strong social security system in our country, the urban populace is very much dependent on continuing economic growth to be able to reduce the risks of high financial dependence. Innovations and entrepreneurship would flourish only when financial independence is achieved. Also on growth stalling, the risks of social unrest increase quite significantly. The twin risks of high consumption and high liabilities need to be resolved in order to overcome the scenario of urban serfdom.

Sunday, May 02, 2010

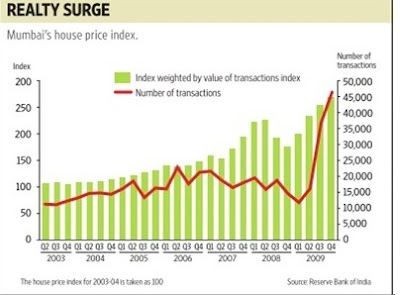

Residential Bubble

(Source : Nomura Research)

(Source : Nomura Research)

Tuesday, January 26, 2010

Inflexion Point

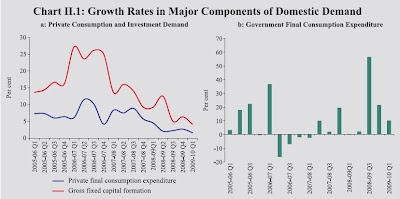

(Source: RBI Q2 review)

(Source: RBI Q2 review)The main risk factor which i had pointed out in my last blog is going to play a key role in the coming few days. Global economies are currently facing a key decision factor with regard to economies recovery. key countries which had implemented fiscal and other incetives to boost their economies during the period of 2008-09 are now being forced to think and act on removing these incentive schemes due to rising inflation. China has started the process, India is expected to raise interest rates in the coming quarterly policy review. The declines in global markets and strong performace of the dollar over the last one week are a reflection of the fears that market participants have, on the adverse impact due removal of these incentives. The declines indicate that the market feels that the recovery was due to these incentives rather than due to any demand recovery. So what does all this hold for India? The impact of the increasing risk aversion to emerging markets due to fears of a bubble or lower growth due to increasing monetary tightening is being felt and would continue for the next few weeks.

Let us analyse the performance of the Indian economy through the basic GDP formula, Y= C+I+G+NX.The growth of the Indian economy over the last few quarters has been helped to a great extent by the fiscal push by the government (G). The last quarter has seen the impact of the fiscal push through increased growth in the social and community services expenditure, which is funded by the government.With the government looking at reining in the fiscal deficit, the key growth factors for the Indian economy would be the recovery of the private consumption(C) and Investment(I). With the world economy still weak, growth in the exports would be lower, hence the need for C and I to grow. Growth in Private consumption fell to 1.6% in the first quarter of 2010 and but increased by 5.6 % in the Q2 2009-2010. The impact of the bad monsoon is expected to be felt in Q 3 2009-10 and this is expected to adversely impact the consumption in rural india. Investment growth has still not picked up. The Q 3 2009-10 could see a lower growth as compared to Q 2 2009-10 which had seen the main impact of increased government expenditure and private consumption.So is the government going to start the process of removal of incentives or has the Indian Economy recoverd and is ready to move forward with Government support? The policy review of RBI may give us some hint on these questions.

Sunday, January 10, 2010

December Effect